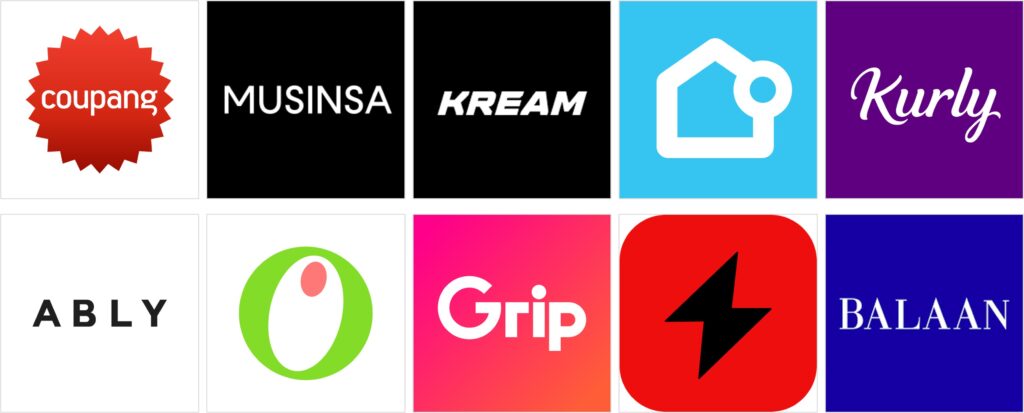

Top E-commerce Apps in Korea – July 2025

From Food to Fashion: Category Leaders in Korean E-commerce

E-commerce apps have become the heartbeat of South Korea’s mobile economy. As one of the world’s most digitally connected societies, Korean consumers rely heavily on mobile devices not only for communication and entertainment, but also for shopping, payments, and product discovery. With a highly competitive market and rapid adoption of tech-driven retail solutions, the e-commerce app landscape in Korea is constantly evolving.

July 2025 reflects several notable trends: fast fashion and beauty platforms are regaining momentum, food delivery apps continue to dominate everyday usage, and fintech integration is increasingly becoming a decisive factor for user loyalty. Additionally, global brands like Amazon are still struggling to penetrate the top rankings, while domestic players like Coupang, Gmarket, and SSG maintain strongholds thanks to same-day delivery, seamless UX, and deep localization.

This month’s download rankings are not just numbers—they’re indicators of shifting consumer priorities, marketing effectiveness, and platform innovation. From impulse purchases on live commerce streams to automated reorder systems, e-commerce apps in Korea are setting global standards in digital retail.

Let’s take a closer look at the top e-commerce apps in Korea as of July 2025, what’s driving their popularity, and what foreign marketers and platform developers can learn from their success.

Korea’s Leading E-commerce Giant

Coupang remains the undisputed leader among e-commerce apps in Korea. Known for its revolutionary “Rocket Delivery” service, Coupang has changed consumer expectations around logistics and speed. Its seamless user interface, personalized recommendations, and vast product range—from groceries to electronics—make it a daily-use platform for millions of Koreans. In July 2025, Coupang maintained its top ranking due to aggressive promotions, AI-driven curation, and integration with Coupang Play (its OTT service). For global brands and marketers, Coupang is not just an e-commerce app—it’s a gateway to understanding Korean online consumption behavior at scale.

The Sneaker and Luxury Resale Hub

MUSINSA dominates the fashion vertical of Korean e-commerce. Originally a community-driven streetwear site, it has evolved into a fashion powerhouse offering both high-end and casual brands. With curated collections, exclusive collaborations, and influencer marketing, MUSINSA appeals to Gen Z and Millennial shoppers. It stands out among e-commerce apps for its strong editorial voice and trendsetting product mix. In July 2025, its mobile downloads surged, aided by seasonal fashion campaigns and global K-fashion interest.

Streetwear Meets E-Commerce

KREAM, owned by Naver, is Korea’s premier platform for authenticating and reselling sneakers, luxury goods, and collectibles. With blockchain-based verification and peer-to-peer trading, KREAM ensures product legitimacy, which is vital in the high-stakes resale market. Its rise as a top e-commerce app reflects the strong consumer appetite for limited-edition drops and investment-grade fashion. In July 2025, it saw spikes in user engagement tied to exclusive collaborations and influencer-led resale trends.

Lifestyle and Interior Inspiration

Today’s House began as a home decor inspiration platform and grew into a full-fledged e-commerce app catering to Korea’s booming interior design market. From furniture to DIY kits, the app lets users shop the exact items featured in curated user spaces. Its community-first approach—featuring real user-generated content—sets it apart from traditional home shopping apps. The app’s performance in July 2025 reflects a broader trend: the personalization of living spaces, especially among young, urban dwellers.

Premium Grocery Shopping at Your Fingertips

Kurly, best known for its “Morning Delivery” service, offers a premium grocery shopping experience that resonates with Korea’s urban professionals. Unlike bulk retailers, Kurly emphasizes freshness, curation, and gourmet brands. It’s not just an e-commerce app—it’s a brand that conveys lifestyle. July 2025 marked a key moment for Kurly, as rising food costs pushed more consumers toward trusted, quality-first online grocers. Kurly’s intuitive UX and trustworthy delivery keep it in the top tier.

Real-time Fashion by Influencers

ABLY leverages influencer-driven commerce, providing fast-moving fashion options tailored to real-time trends. Its algorithm-driven curation suggests outfits based on user behavior and preferences. This e-commerce app stands out by combining entertainment and shopping, making it a favorite among younger consumers who are influenced by creators more than brands. In July 2025, ABLY’s mobile download rankings climbed thanks to summer fashion hauls and creator-led discount events.

Beauty Meets Digital

OLIVE YOUNG, Korea’s largest health and beauty retailer, has transformed its app into a fully digital beauty assistant. Featuring virtual try-ons, skin type-based product suggestions, and exclusive app-only deals, it’s more than just an online store. OLIVE YOUNG’s app has become an essential e-commerce tool for Korea’s beauty-conscious consumers. July 2025 saw high user engagement driven by skincare trend shifts and K-beauty exports surging internationally.

Live Commerce Pioneer

Grip pioneered live commerce in Korea, where sellers showcase products via livestream while viewers shop in real time. This format blends entertainment and retail, appealing strongly to impulse buyers and curious browsers. The app saw a resurgence in July 2025 due to viral content formats and live events hosted by popular creators. It stands as one of Korea’s most interactive e-commerce apps, bridging the gap between brand experience and direct purchase.

Secondhand, First Choice

Bungaejangter, or “Lightning Marketplace,” is Korea’s leading secondhand e-commerce app. From tech gadgets to fashion, users trade securely with in-app payment and courier services. The platform has evolved into a lifestyle choice, especially as sustainability and cost-saving become consumer priorities. In July 2025, its popularity grew as more users sought value-driven alternatives to fast retail. For brands and analysts, Bungaejangter represents the rise of circular commerce in Korea.

Luxury Redefined for Mobile

BALAAN offers authenticated luxury goods through direct partnerships with European boutiques and global brands. It bridges the gap between global luxury and Korean consumer trust. With exclusive app-first drops, AR try-on features, and concierge delivery, BALAAN delivers a premium e-commerce experience tailored for Korea’s mobile-first audience. Its July 2025 performance reflects the continuous demand for luxury goods among Korea’s affluent digital shoppers.

What E-commerce Apps Reveal About Consumer Behavior

The July 2025 ranking of Korea’s top e-commerce apps highlights a mobile-first economy that values speed, personalization, and trust. From dominant players like Coupang to niche platforms like BALAAN and KREAM, the Korean e-commerce market reflects a complex mix of convenience, culture, and digital innovation. Whether it’s groceries delivered before dawn or luxury bags authenticated by blockchain, these apps aren’t just shopping tools—they’re lifestyle platforms shaping how Koreans discover and buy products. For global businesses and marketers, understanding the dynamics behind these top e-commerce apps offers valuable insights into one of the world’s most advanced mobile shopping ecosystems.

Stay Ahead in Korea’s Market!

Want to understand Korea like a local marketer?

Join thousands of global professionals who rely on KoRank for real-time insights into Korea’s fast-moving digital, consumer, and tech landscape.

By subscribing to our newsletter, you’ll receive:

🔎 Monthly market briefings with exclusive analysis

📊 Industry rankings and brand performance snapshots

🚀 Emerging trends across e-commerce, mobile, and social

🧠 Expert tips on local platforms like Kakao, Naver, and Coupang

🌍 Case studies of global brands succeeding in Korea

Whether you’re planning market entry, exploring partnerships, or staying competitive—KoRank keeps you one step ahead.

👉 Subscribe now and unlock smarter decisions in Korea’s dynamic market.